A When, not if Investment - Uranium.

It’s very hard to invest in Uranium via futures, as it’s a very small market and more importantly, you can’t take physically deliveries without the cops showing up.

Before I talk about which uranium companies, I just want to share that uranium is the most explosive commodity out there.

In fact, the last uranium bull market, it didn’t just allow people to buy houses, it allowed people to buy islands but it’s a bit tricky to invest in.

It’s very hard to invest in Uranium via futures, as it’s a very small market and more importantly, you can’t take physically deliveries without the cops showing up. Almost everyone invests in this sector via some sort of Equity.

A Case for Why Uranium

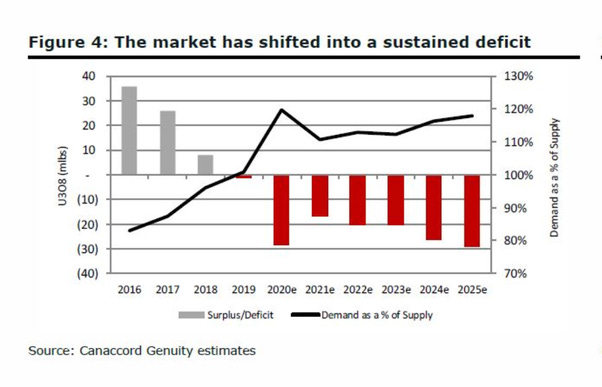

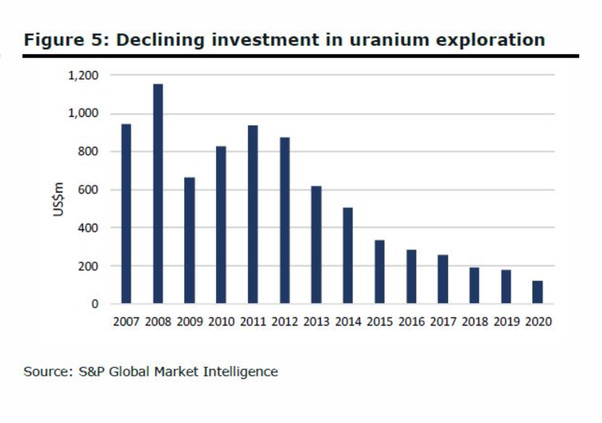

The 2 charts below basically sum up the thesis for the “why” for investing in uranium during the 2020s…

If you didn’t know how macro/cyclical industries work, it goes like this…

Capital expenditure falls → Less supply in the future → Margins expand → Profitability increases → Attracts competition → Capital expenditure rises → More supply in the future → Margins shrink → Profitability decreases → Capital expenditure falls → …

From 2011 to 2020, capital expenditure in uranium has been falling, so it’s clear where we are headed.

In recent years, uranium stock prices trended lower because uranium prices fell to levels so low that mining became unattractive and cost-ineffective. When it doesn’t make economic sense to mine, companies halt production and that’s exactly what top uranium producers did.

Cameco and Kazakhstan’s Kazatomprom restricted supply with a view to boosting the uranium spot price, and they succeeded. Since late 2016 when uranium prices were $18 per pound, prices have increased to the north of $26 per pound.

Yet higher uranium spot prices haven’t translated to higher share prices across the board for Cameco, one of the largest uranium producers. One reason the Cameco share price may have been slow to turn around is that nuclear facilities buy uranium through long-term contracts, with delivery times scheduled as far as 4 years out in time.

What are your investment options?

1 - Buy stocks in Holding trading and royalty companies

2 - Buy an ETF filled with uranium miners. -(This option also has limited upside because the diversification in any ETF will dilute your gains.)

3 - Choose your own basket of uranium mining companies to invest in -oh boy 😅

Holding trading and royalty companies: there are 2~4 companies of this, i.e they don’t mine anything directly, but hold inventory that they can sell through either contract with producers or just buying on the spot market, the most notable is Uranium Participation Corp and Yellow Cake, the Chinese Giant CGN’s subsidiary CGN Mining also falls under this category, as is Uranium Royalty. These are probably the middle ground between the Majors and Juniors, i.e they offer pretty significant potential to go up in a bull market, but is considerably safer than most junior miners

I’ll go a bit into more details on option 2 & 3.

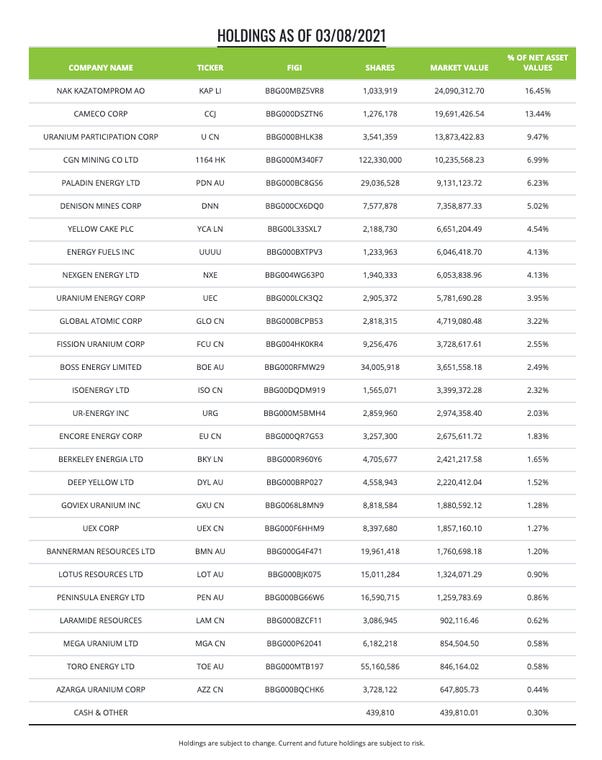

An Interesting ETF is URNM, Below are the holdings of the URNM ETF (note that these weightings and names can change over time, so it’s important to check its holdings before investing)…

Typically, the more “stable” names in uranium (the companies towards the top of the list) will have bigger weightings in the ETF.

This is just how they decrease volatility risk for investors.

Typically, these more “stable” names are the safest uranium names, but they also have the least upside potential. Just something to keep in mind.

Now, the third option is to choose your own basket of uranium mining companies to invest in.

In order to do that, it’s important to understand the difference between uranium explorers, developers, and producers…

Uranium Explorers - These are uranium mining companies that are still exploring their patch of land to see if there’s any viable uranium to extract.

Uranium Developers - These are uranium mining companies that know how much uranium they have in the ground and the quality of the grade, and are building the infrastructure for functional production.

Uranium Producers - These are mature uranium mining companies that are extracting and producing uranium off the ground, making money from signing contracts with utilities and selling uranium.

Most of the uranium names I Invest in are either in the mid or late development stage.

Uranium explorers are nice, too, but they’re the companies where you’d find the most snake oil salesmen because a lot of them just have this…

A piece of land (minus the cow). As a result, they have to do heavy promotion, advertising, and marketing to incentivize investors to invest in their patch of land.

Explorers have the most upside because they typically have the smallest market cap. And so, when the uranium sector heats up and institutional + retail capital comes into the space, their share prices will skyrocket like no other.

Again, from a fundamentals perspective, most of these explorers won’t make it to production this cycle. only 2 companies in the last uranium cycle went from exploration to production?

Paladin Energy

A mine that had Kazakhstan government funding.

It should be said that mining is an inherently risky business, so it’s important to do your own due diligence.

For clearer context, you can look at Developers and explorers in two categories also

Majors: Which is effectively only two companies, Cameco (CCJ) and Kazatomprom (listed in London and other European exchanges. ) they are the two biggest producers by far (though CCJ is not producing anything right now.) They’re probably the safest plays, but offer relatively limited upside (maybe 2x~3x ?) they’re the two largest weighted companies in all ETFs

junior Miners: i.e mining companies that aren’t Cameco and Kazatomprom: these are the highest risk highest reward plays for this space, as many aren’t even producing right now (plenty don’t even have mines built yet!) but these type of companies are the most likely to 100x~1000x in a bull market.

And so, if you’re thinking about picking your own uranium miners, it’s important to have a basket of them and just watch them run over the coming years.